Building a solid financial foundation isn’t just important due to the time value of money and the power of compounding interest. More foundationally, building healthy financial habits at an early age or early in your military career will build muscle memory to make fiscally responsible actions and decisions in the future. This post is going to talk about various foundational actions you can take to start your journey to financial independence off on the right foot. Read below!

- Education Is Extremely Important – But Don’t Pay for It:

- Bottom Line up Front: There’s no reason or excuse not to get a degree either before, during, or after you’re in the military; regardless of rank, it will help your promotion potential and make you more of an informed decision-maker and leader at each position you hold. However, there’s no reason to take out loans or pay out-of-pocket for education if you’re planning on a career as a service member or are already in uniform. Success in the military doesn’t require going $200,000 into debt for an Ivy League education and will ultimately make early financial independence a challenge; servicing college debt early in your career will come at the expense of early investments. Going to a solid, accredited school and finding a funding source is the key. Also, starting a career without hundreds of thousands of dollars of debt will allow you to accumulate assets more quickly (see below) early in your career.

- Prior to joining the military, there are two, primary ways of getting a fully-funded bachelors degree: Reserve Officer Training Corps (ROTC) Scholarship or appointment/acceptance to a Service Academy (West Point, Naval Academy, Air Force Academy, Coast Guard Academy, or the Merchant Marine Academy).

- Once in the military, there are a variety of ways of getting funding support for a degree program. The majority of funded education programs are also used as retention tools and come with an additional duty service obligations (ADSO). Speaking specifically for the Army, there are four, primary categories: Green to Gold program, Tuition Assistance, Advanced Civil Schooling (ACS), and use of the GI Bill. The “Green to Gold” program offers Enlisted Soldiers an opportunity to finish a fully-funded bachelors degree while on active-duty; following graduation, they will receive a commission as a 2LT. The Tuition Assistance (TA) program offers assistance on a per-credit-hour basis and can be utilized while still performing your current job/assignment. The ACS program allows individuals to receive a fully-funded graduate degree while receiving active-duty pay at an accredited institution and may be tied to a fellowship, scholarship, training agency, follow-on instructor position, or a required utilization tour. Lastly, it is possible to use your GI Bill while on active-duty; however, all other options should be exhausted before using this benefit.

- Asset Accumulation:

- Bottom Line up Front: The early stages of investing should be heavily focused on asset accumulation; the key is to find assets which are likely to appreciate versus a depreciating asset (i.e. don’t buy a new, F-250 every year). Inflation is the enemy of your paycheck and passive income streams, so parking capital in assets that will beat inflation is key. This can include real estate, stocks, bonds, exchange traded funds, index funds, certificates of deposit, etc. An important consideration is to avoid over-leveraging to obtain an asset (debt is a powerful and useful financial tool if used appropriately). There is no approved solution or perfect balance of assets, but the general rule of thumb is to invest in financial sectors you understand and are genuinely interested in. The only wrong answer is to do nothing; cash parked in a traditional checking/savings account is actually losing money every day in an inflationary environment, even when the balance stays the same. At a minimum, if you’re planning on parking capital in a savings account, find a High Yield Savings Account (HYSA).

- Dollar-Cost-Averaging: With the amount of energy and time you’ll invest in your career, putting financial investing on auto-pilot by utilizing automated platforms for dollar-cost-averaging have been useful for many service members; it also keeps emotion out of the investing equation, allows you to take advantage of all points in the market cycle, and avoids you attempting to beat the market. With dollar-cost-averaging, consistency is key and “time” will beat the market over the long-term so you don’t have to try to win every day.

- Diversify Investments: Diversification is a hedge against a downturn in any one, particular market sector. Without a crystal ball, you don’t know which areas of the market are going to do poorly. Diversification reduces risk by parking capital across multiple, market sectors to avoid excess exposure in one area.

- Leverage Wisely:

- Bottom Line up Front: Debt is not your enemy, it’s the excessive and irrational use of loans that can increase your liabilities exponentially, reducing your capacity to cashflow on investments, and exposing you to undue risk. A perfect example of this is a career-starter loan upon graduation from a Service Academy or ROTC program. You can typically receive one of these loans of up to $30,000 for under 2% interest. Taking out cheap money, under the rate of return you can expect in a marketable security, makes sense (in moderation), as long as there in cash flow to service that debt each month. In this example, that $30,000 can be placed in a diversified exchange traded fund (ETF) or index fund with broad market exposure and expect to have an annual rate of return of approximately 8%. In this example, debt increased earning power and leaves you with a 6% profit margin using someone else’s money (the bank’s!) at a cheap rate.

- More than Budgeting:

- Bottom Line up Front: Controlling your expenses is important and avoiding frequent or excessive impulsive purchases is a critical component in a path to financial freedom, but only focusing on budgeting doesn’t paint the full picture. Once monthly expenses are accounted for, excess capital must still be employed to go to work for you, so you can retire early. Having a closely-followed budget is only half of the equation and will get you far less than half of the way to financial freedom. Money may not be able to buy happiness, but the lack of it can certainly rob you of your time. Every excess expense or luxury purchase you make may give an instant, fleeting feeling of gratification. However, it will certainly push you further from retirement and reduce the amount of available time you have to pursue any hobbies/passions full-time. While you could drive yourself crazy agonizing over every dollar (I think that’s a bit much and wouldn’t recommend it), below follows the long-term, net effect of a simple decision to avoid buying a cup of coffee on a single day across a career-spanning investment window.

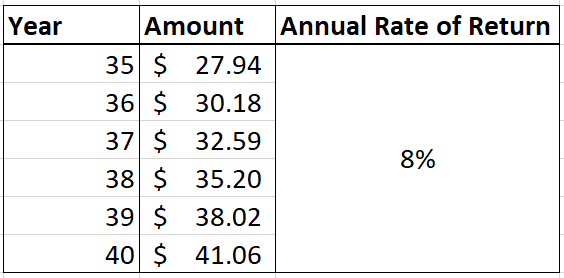

- Mark decides to forego his daily cup of coffee during his commute to work, saving $1.89. He only does this one day, and doesn’t consider any impact besides getting to work a couple of minutes earlier without the wait in the drive-through line. What Mark doesn’t realize is the power of that dollar across a 40-year investment horizon. If, say, Mark decided to invest that $1.89 in a market/sector-tracking fund in lieu of his savings account, that $1.89 would be $41 at the time of his retirement, assuming an annual rate of return of 8%. While $41 may not be anything to write home about, imagine the compounding effects of multiple decisions of this magnitude being made every day, week, and month for 40 years!